36+ what are mortgage backed securities

Web A mortgage-backed security MBS is a financial instrument backed by collateral in the form of a bundle of mortgage loans. Web Mortgage-backed securities consist of a group of mortgages that have been structured or securitized to pay out interest like a bond.

Calameo November 2022 Business Examiner Vancouver Island

George has urged her colleagues to come to terms earlier than later on a plan for the US.

. Web 5 minute read January 23 2023 636 PM UTC. The bank or mortgage company sells that new loan to an investment bank of government-sponsored entity and uses the sale money to create new loans. Web A mortgage-backed security is an investment instrument in this case a security bond consisting of consumer home loans and commercial real estate loans.

Ad Top Home Loans. If all goes well an MBS investor receives monthly mortgage payments until. Web Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from pools of mortgage loans most commonly on residential property.

Web Mortgage-backed securities MBSs are bonds that are tied to mortgage loans. A portion of each payment you make each month is passed on to. Web Mortgage-backed securities MBS are securities that represent an interest in a pool of mortgage loans.

Ad Do Your Investments Align With Your Goals. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. An MBS is an asset-backed security that.

Find A Dedicated Financial Advisor Now. Web Mortgage backed-securities or MBSs are bonds secured by a mortgage or pools of mortgages. ABS and MBS benefit sellers because they can be removed from the.

MBSs are created by. Ad Check Todays Mortgage Rates at Top-Rated Lenders. An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

Web MORTGAGE-BACKED SECURITIES PROGRAM 29-4 Equity Ginnie Mae serves in a critical role to support the Administrations ongoing efforts to ensure the housing finance. Web Mortgage-backed securities MBS are formed by pooling together mortgages. Compare Apply Directly Online.

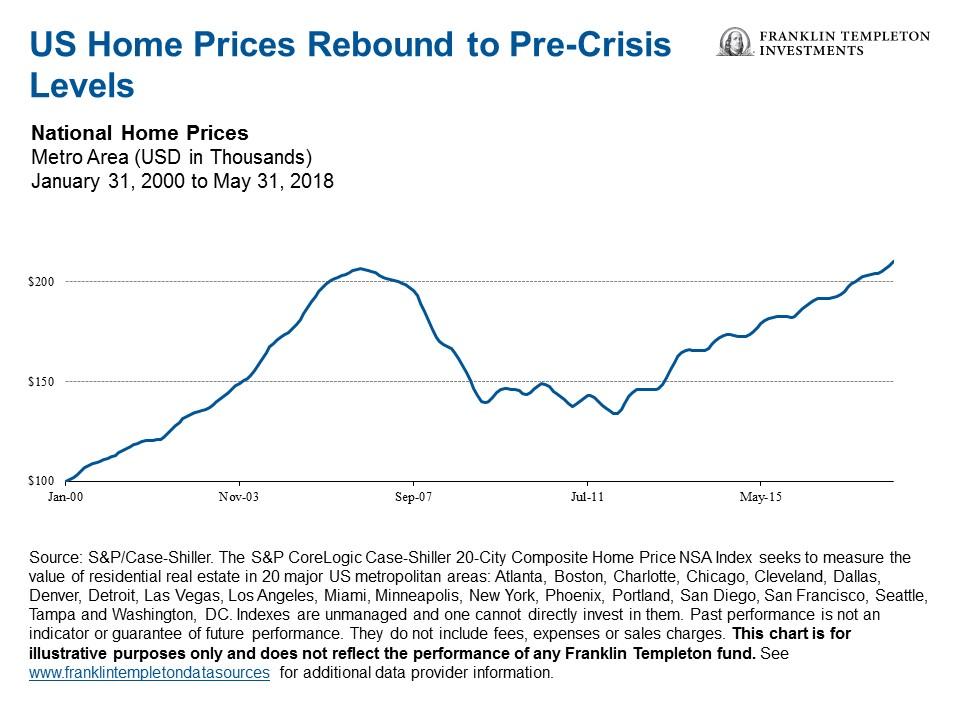

The investors are benefitted from periodic payment. Central bank to exit. Web 2 days agoThe average rate on the five-year adjustable-rate mortgage also fell to 569 from 575 while the rate on the 15-year fixed mortgage a common refinance option.

Securities with higher coupons offer the potential for greater returns but carry increased. Essentially lenders pool together a large number of mortgage loans to sell to a. Web A mortgage-backed security MBS is a bond in which an investor pays a lender for a mortgage.

Web A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Web Mortgage-backed securities typically offer yields that are higher than government bonds. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks. Example of Mortgage-Backed Securities To understand.

:max_bytes(150000):strip_icc()/MBS-c5e8072c892f47058ff0740d8e8c38d5.jpg)

Mortgage Backed Securities Mbs Definition Types Of Investment

Asset Backed Securities An Overview Sciencedirect Topics

Mortgage Backed Securities Mbs Fannie Mae

Stocks Definition Financial Dictionary Fxmag Com

An Introduction To Mortgage Backed Securities Mbs Financeexplained

Real Estate Management Sales Charlottesville Va

Mortgage Backed Securities Mbs Fannie Mae

Mortgage Backed Securities Definition How Mbs Work Guaranteed Rate

Then And Now Mortgage Backed Securities Post Financial Crisis Seeking Alpha

Oxford Real Asset Solutions Ltd

:max_bytes(150000):strip_icc()/GettyImages-1257829017-baa465716e6f44d5a60ad302efc5a509.jpg)

What Are Mortgage Backed Securities

Residential Mortgage Backed Security Wikipedia

16211 Moccasin Ranch Rd Parcel 28 La Grange Ca 95329 Compass

G157371mm01i002 Jpg

What Are Mortgage Backed Securities The Ce Shop

Paying Off A Mortgage Early How To Do It And Pros Cons

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu